Gone are the days when saving and hoarding cash in the bank was your best money-saving option. In today’s global economy, saving money in the bank just won’t cut it. There’s nothing wrong with saving money; however, the increasing inflation rates will easily make your money lose its value.it is possible to find savings accounts with good interest rates, but they’re few and far between. That is why so many millennials and older generations have turned to investment opportunities.

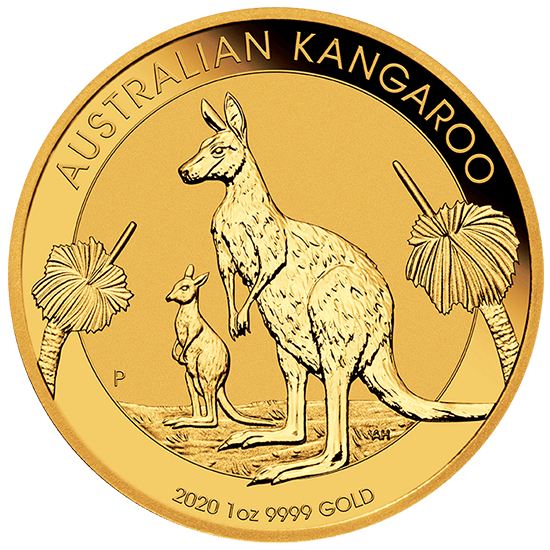

In essence, investing is putting your money in a place where it will “grow”. This means infusing it in a business, mutual fund, or investment in bullion or coins, preferably from Perth mint, by which significantly higher returns can be yielded compared to a banks interest rate. If you are interested to learn how to start or be a better investor, here are the top tips for you:

- Act on facts, not feelings

One essential quality an investor should have is objectiveness. You must look at the facts, data, and market trends, and use this information to guide your investments. You should not merely act on “gut feels” as these can be misleading. It is also important to maintain mental fortitude. Often, when a stock falls, newbie investors will sell it out of fear. Remember that eventually, the stock price will go up again. Another rookie mistake is getting overly excited by a well-performing stock and selling it prematurely. As much as possible, keep your investment in the market for more than ten years for it to compound and increase in value. Do not be easily swayed by your emotions, most especially fear and excitement.

- Don’t Put All Your Eggs in One Basket

An important concept to note when investing is “diversification”. The market value of each industry or business fluctuates from time to time. With that in mind, it is much better to have small investments across multiple platforms, such as insurance, Perth mint coins, bonds, stocks, real estate, and annuities, instead of investing all your money into one company. Having multiple investments across different industries lessens the chance of losing your capital all at once. These multiple income streams also give you security. If one stock is underperforming, you have a couple of others to make up for it.

- Be Patient and Invest for long-Term

Investing takes patience. When making big investments, always stay for the long-term. Historical performance of the market indicates that the value of a firm will always go up despite pitfalls. If you don’t have an immediate need to liquidate your investments, wait it out a couple more years. The longer you wait, the bigger the value of your investment. It is a waiting game.

- Invest Early Into the Game

Start early! You don’t need a million bucks to make your first investment. Once you start earning a wage, set aside a few bills to invest in stocks, bonds, etc. Over time, these small amounts will accumulate and compound. Investing early does not also stop at the market, but it also includes investing in yourself. If you are in your early teens, twenties, or are currently unemployed, invest in yourself by purchasing investment books or saving money to fund investments in the near future.

- Read, Research, and Analyze Your Findings

If you want to get better at something, you must practice and continuously learn. The best way to do that is through research, by reading books, attending seminars, or even chatting with a fellow investor. Investing is not just a practice but a skill. Knowing where, how, and when to invest is a skill that you can develop with the right review materials and mindset.